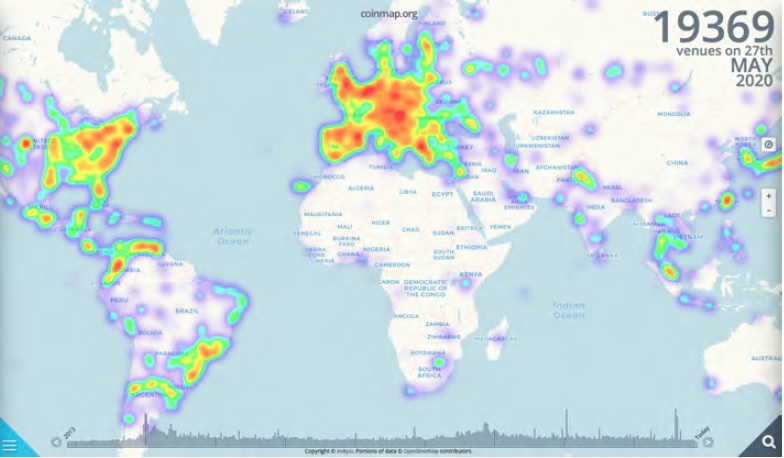

NFTs have been the talk of the crypto community for a few years now, and with each passing year, their potential seems to grow. What was once the preserve of digital art collectors and highly speculative investors is now something that could be used on everything from subscription services to online bitcoin casinos, giving players a chance to unlock extra content, features, and more.

But can these digital tokens hold a store of value just like bitcoin and precious metals? Do they have as much potential as an asset, and what does the future hold for NFTs?

What is a Store of Value?

Before we discuss the potential benefits of NFTs as a store of value, we need to address what this term actually means.

A store of value is simply an investment that holds its value. It is an asset or commodity that does not rapidly depreciate over time, allowing the investor to dip into their investment and withdraw as needed.

Gold and silver are some of the best examples, as the market has valued these metals since the dawn of civilization, and they tend to hold their value over long periods of time. If you have a large store of gold, you know you’ll always have a reliable investment that you can add to and withdraw as required.

On the flip side, a classic car is not a store of value asset. It might have a high value to begin with and it might even be considered a collectible, but it’s a car and it will deteriorate both in quality and—probably—price as long.

A nation’s currency is also a store of value, as it’s an asset to which a value is assigned. When you’re given your paycheck every month, you’re relying on that money to have a certain value, one that hasn’t changed greatly from the previous paycheck.

Is Bitcoin a Good Store of Value Asset?

Bitcoin has a lot of potential as a store of value asset. As with gold and silver, it can be collected, stored, and then sold as needed. And unlike bonds and other potential store of value assets, it doesn’t need to be sold in its entirety.

You can sell fractions of bitcoin and withdraw only as much money as you require. More importantly, your bitcoin collection is 100% digital, so you don’t need to go to the trouble of finding a dealer, negotiating a price, and then lugging your gold halfway across town to sell it.

Bitcoin is not as stable as silver or gold, but if you look at its price over the long term, and focus on the bigger picture, it has been pretty reliable.

NFTs as a Store of Value

NFTs definitely have potential as a store of value asset, and that potential is already being realized.

What makes them so unique is that they are non-fungible, which means every token is completely unique. A fungible token, such as a bitcoin, is just like every other, and 1 can always swap for 1.

A non-fungible token is more like a personalized coin or a signed baseball card in the sense that it can’t simply be swapped for other coins or baseball cards as the value is not the same.

Multiple tokens can also be created for a single item, such as a piece of art, and this creates more liquidity as it means the seller only needs to find a part-buyer.

Imagine, for instance, that you own the Mona Lisa, and it has been valued at $500 million. It’s a hefty asset, but you’ll have a hard time selling it. Not only do you need to find the auction house capable of handling such an expensive piece of art, but you also need to find the buyers who have half a billion dollars to spend on a painting.

On the flip side, if you were able to break that artwork down into 500 pieces, each selling at $1 million, you’d never have an issue selling one or more of those pieces, as more people are willing to spend that sum of money on artwork.

It means you don’t need to worry about selling at the right time or through the right people, and that creates a sort of liquidity that is often lacking in the collectibles sector.

Every single person who owns that painting will be given their own unique code—their own segment of the Da Vinci masterpiece. They’re not just “1 of 500”. They are “Mona Lisa 234”, and that’s something that only they can have, and only they can sell.

It’s not just about artwork and other collectibles, either. NFTs can also be used to purchase other expensive assets, such as real estate. They provide the means of breaking large and unachievable investments into small and affordable chunks, without losing any of the innate value in the process.

That’s what NFTs can do for investors and for the financial sector on the whole, and that’s one of the many reasons that so many people are getting excited about them right now.

Article written by Cloudbet – the leading bitcoin casino