The ability of AI and machine learning to revolutionize the way we trade has always been a matter of research. But now as we have entered the crypto era and started trading digital currencies, the significance of AI in trading is more than ever.

Amongst the projects and experiments being run worldwide regarding the applications of AI in crypto trading, some have proven to be very revealing about the ways AI can help improve the overall trading industry, especially the way crypto trading works.

If experts are to be believed, AI can bring a number of

advantages to crypto trading, including the deeper analysis of historical data,

use of advanced algorithms for making predictions based on research, studying

the market for changes, among other things.

Besides these, here are some other major ways in which AI is disrupting the future of cryptocurrency trading.

1. Computer

algorithms for trading

The use of computers in the trading market is not new.

However, in the past couple of years, the percentage of trading through

computer algorithms has drastically increased to more than 50%.

This is even more common in the trading of cryptocurrencies,

as everything else is digital, so no one wants to trade manually any longer.

It is obvious that trading through AI-based, smart

algorithms is faster and more efficient compared to human-based trading and

results in fast-decision making, which is crucial for the cryptocurrency

trading sector.

2. AI for analysing

data and making predictions

The use of advanced technologies such as artificial

intelligence and machine learning for analysing the market data, past trends

and trades and providing actionable insights for future predictions is now more

common than ever.

Projects like Cowrium (Stability AI) are doing amazing things in this area by providing traders with easy and actionable investment advice based on the study and analysis of historical market data, trends, etc. for fast decision making.

3. AI for filtering

through zettabytes of data

The amount of digital data is now in zettabytes, which means

we have more digital data than we can ever store or use or parse through by

natural means.

AI is probably the only technology available to humans that

can not only filter through these vast amounts of data but also help us

understand and make use of it in a way that makes sense. If not for AI, it

would have been too complex to understand this data, let alone make any useful

financial/trading decisions based on it.

There are a number of trading markets, including some crypto trading platforms, that are already using AI and machine learning for help with the overall decision-making process.

Research reveals that AI hedge funds deliver

better performance over a period as compared to traditional and manual funds.

There are a number of businesses that are making use of AI

in the hedge fund market for analysing the trends and providing better insights

for decision making. While some of these fund managers are only using partial

features of AI, others have gone full-AI for trading as well risk-management in

their funds.

5. AI Neural Networks

for analyzing marketing efficiency

According to a study that involved the use of Artificial

Neural Networks for analysing the performance of various markets and

identifying those with weak performance, the use of AI in the investment

strategy can drastically improve the efficiency and results.

The said study involved testing of the applications of

neural networks for analysing the historical market data and predicting the

future returns and rates based on the findings. The study was immensely

successful, as the use of neural networks helped generate predictions for the

future year based on the data of the previous some years. And the produced

results were even better than the average results of buy-and-hold portfolios.

6. Identifying market

irregularities

For some years now, AI and machine learning are being used

by organizations worldwide for studying market irregularities and changes such

as acquisitions that are yet to happen and other things that may somehow

manipulate the market.

A reputable asset management company reportedly used

sophisticated genetic machine-learning systems based on AI to predict a number

of acquisitions before they were even published, thus making significantly

higher returns. AI algorithms reportedly tracked insider trading signals that

enabled them to predict these acquisitions.

By being able to identify irregularities, crypto fund

managers all around the world can better estimate market manipulations such as

upcoming acquisitions and adjust their portfolios accordingly. Projects like RoninAi are successfully using AI algorithms

to predict cryptocurrency market manipulations based on changes in social

sentiment indicators.

7. Prone to financial

turmoils

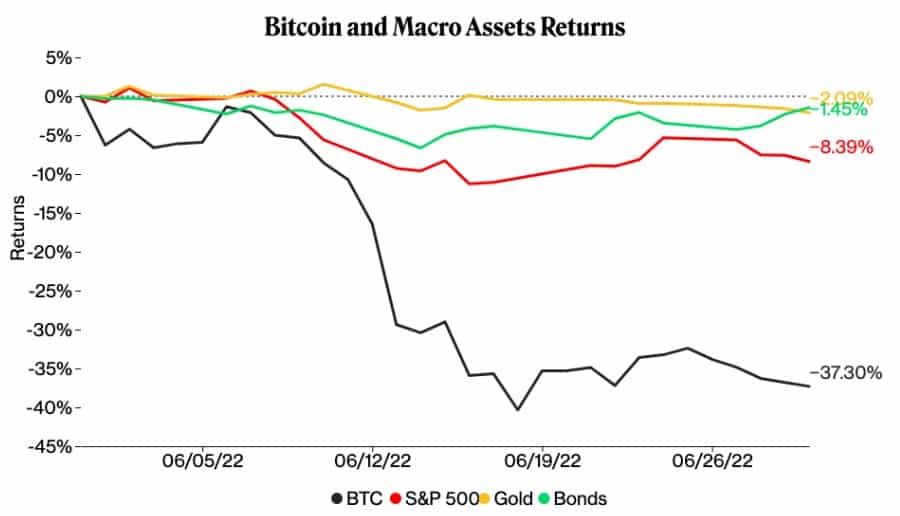

Multiple studies suggested that artificial intelligence

algorithms are able to assist with profitable investment decision-making not

just in normal times but also they perform well at times of financial

disorders.

The organization that was a part of this study managed to

make significant profits with the use of AI algorithms, of which most profits

were made during the times of financial trouble. This indicates that neural

networks are able to provide significant insights even when the market is not

doing so well.

Even though the study was performed in standard cases on

traditional funds, the same results are expected for digital currencies and

funds as well. The use of AI neural networks can significantly assist the whole

decision-making process in crypto trading and investment.

Final Thoughts

As we are moving ahead in a world that is largely dominated

by competition and increasing demand for resources, understanding and making

use of advanced technologies like blockchain and AI can immensely help with our

goals of a better, richer world.

AI is a machine intelligence technology that can develop its

own intelligence based on the data and information that is fed to it. This type

of intelligence can be widely used in not just the finance world but in a range

of industries, including crypto trading, for being able to make profitable

market predictions and decisions based on actionable insights generated through

in-depth study and analysis of the past trends.