Numerous tech solutions are being hosted every day by various organizations worldwide. Surprisingly, each of them is used at least once by people. It indicates their tremendous demand; specifically, blockchain ones have generated a huge hype among people. Wide varieties of platforms have been published, and each of them has gained terrific utilization of users due to their rising interest in crypto investments.

Hence, the overall demand for blockchain has grown exponentially as half a percent of the current global population uses a specific tech stack, as per the reports of 2023, denoting the bolstered requirements for blockchain solutions among people. Thus, startup owners brought their blockchain apps into the market and have witnessed a commendable growth in demand.

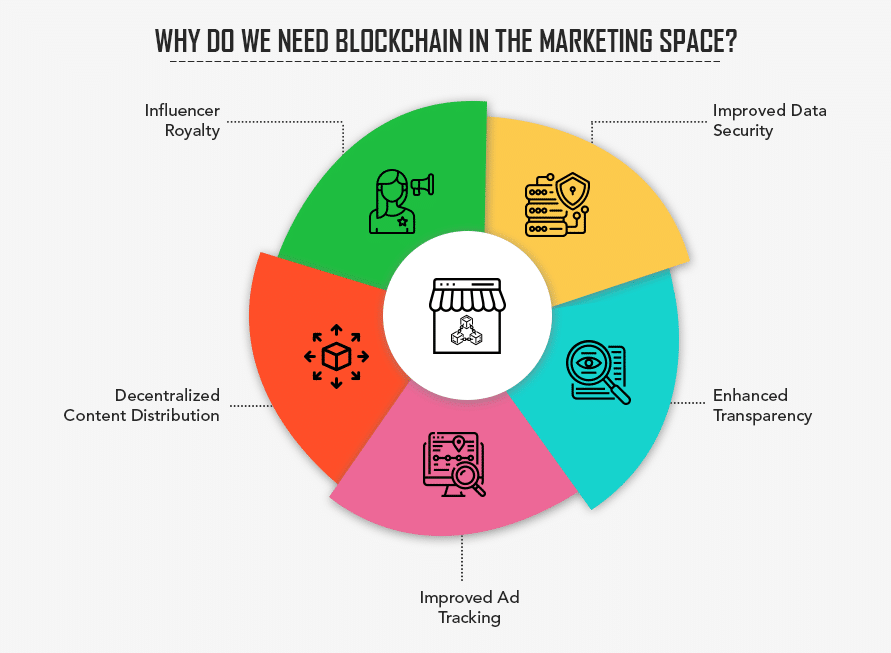

The development of crypto platforms using blockchain technology is expected to rise in years to come. Hence, the blockchain space is getting transformed due to such requirements. With the rise of blockchain, there is a new way of marketing through these applications for ventures to gain insights is discovered.

So what is it? How can it be done through a blockchain solution? And which different perks you receive from it are mentioned here. Read all those sections to get an exact idea of blockchain advertising.

What Does Blockchain Marketing Mean?

The term blockchain marketing involves following several online marketing strategies along with the usage of blockchain tech stuff. To perform the same, entrepreneurs aren’t needed to provide much information to numerous firms.

So, by giving minimal data to the companies, the brands can establish a secure relationship with their consumers by performing targeted promotions on a platform. Furthermore, the blockchain industry is vast enough and has great future requirements that open numerous scopes for ventures to rise higher.

Utilizing particular tech stuff can tailor marketing efforts by visualizing and storing consumer data. It would help you study their behavior more precisely for structuring the campaigns.

If you, as an entrepreneur, are willing to market your enterprise, then some methods for the same are discussed in the next section. They would likely assist you with the same.

Top Blockchain Marketing Techniques That Startup Owners Should Follow

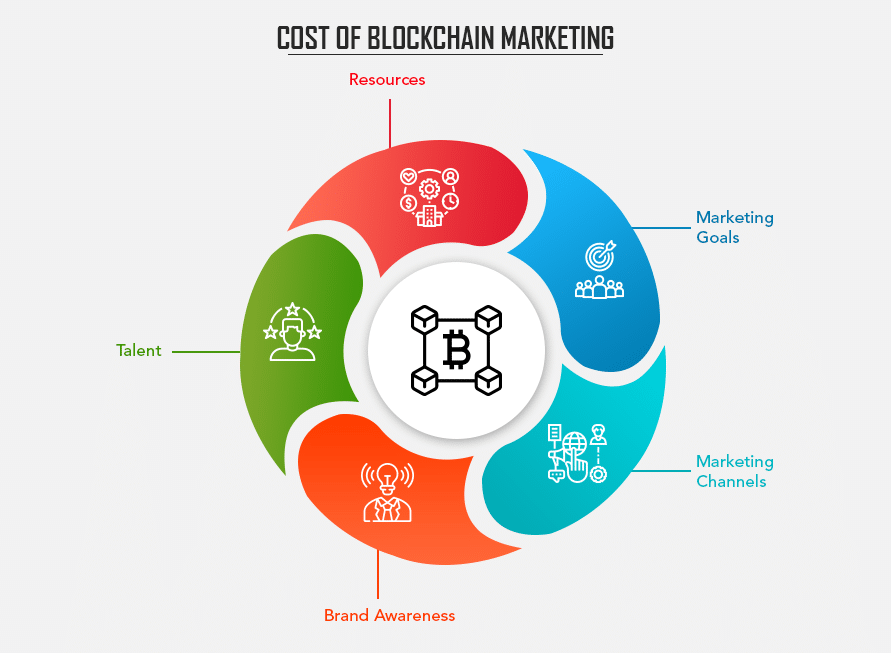

Numerous renowned firms have already entered the blockchain sector by witnessing its potential. They must have analyzed certain pluses. So, if you are keen to know the different ways of promoting a venture, then some of the tactics are stated below:

Influencer Marketing

People nowadays immediately purchase things promoted by renowned celebrities and public figures. They inspire users to buy products of a specific brand by promoting them. At the same time, the entrepreneurs need to pay a particular amount to them. It is called influencer marketing.

Later, this method was endorsed as unauthentic for marketing due to some problems, such as insufficient transparency, inability to measure the ROI, spurious followers, and interactions.

So to avoid such issues and maintain credibility, blockchain seems an appropriate option, as it contains smart contracts in an ecosystem. Utilizing this blockchain feature, you can settle the payment once the desired course of action is performed. In addition, it can also be used to gauge the performance and authenticity of an influencer.

Affiliate Marketing

Sources of 2023 say that the amount of total spending has reached 8.2 billion dollars in 2022 and is further expected to grow exponentially in the years to come. The brands sometimes suffer from certain issues despite paying huge sums of money to affiliates.

Thus, to stay away from such problems, you should use blockchain by performing transactions through crypto, smart contracts, etc. So. it’s advisable for you to perform affiliate marketing utilizing blockchain.

Organizing Loyalty Programs

Usually, consumers become loyal to venture for two reasons by joining the loyalty programs: they are faithful from the beginning or willing to gain discounts. Implementing the use of blockchain technology can show wonders to your enterprise due to the decentralized property.

Various brands can partner with each other and permit customers to redeem points and receive discounts on any brands. Hence, in this way, offering loyalty points with blockchain advancement can lure consumers to your business considerably.

Through Social Media

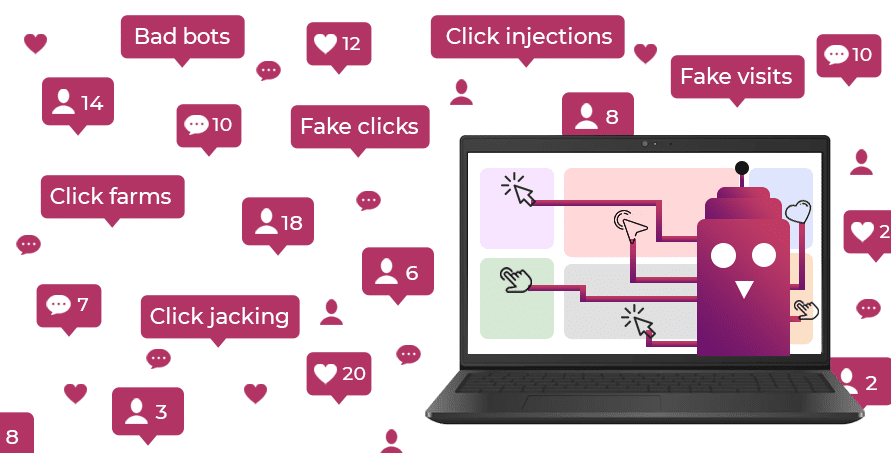

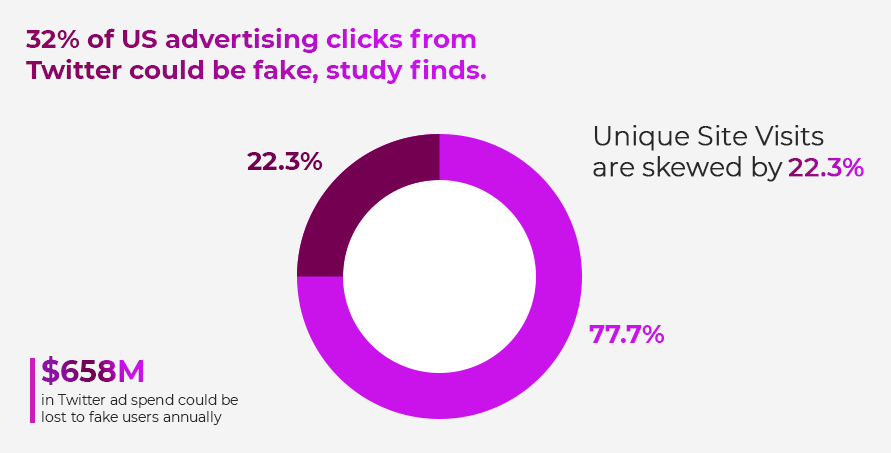

Social platforms are a great medium for marketing an enterprise, but at the same time, there is an equivalent risk associated with it for users. By considering such risks, it can be said that blockchain can be the next marketing dominator.

It is because the users receive maximum safety and guaranteed results for an amount paid. If you are willing to promote your venture socially, then by following several tips for social blockchain marketing, you can perform the same and get pleasing outcomes soon. Integrating blockchain for payments in social media would take security to another level and makes its use preferable for your business.

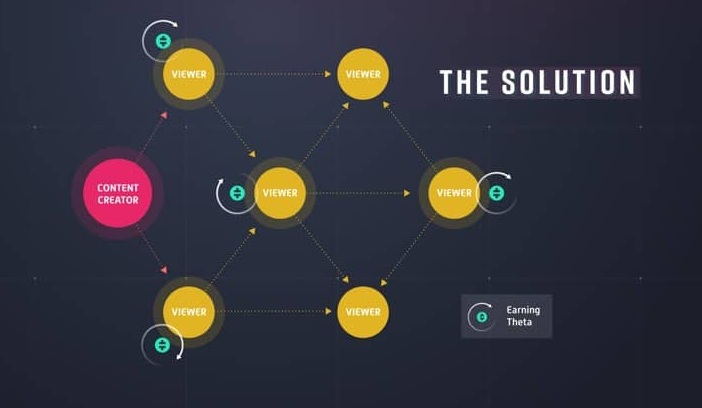

User Incentives

People always like to access a platform from which they are provided a certain ratio of offerings. Thus, by implementing the use of blockchain, you can promote an enterprise to users who are keen on gaining the deals provided to them after they observe an ad.

So, by providing the user incentives, you will receive maximum ROI, as you only require to pay for the number of users viewing your advertisement. In short, it says that your investment in customer offerings would be considerably optimized.

By following the above-discussed marketing procedures, you will likely get assistance in fetching the targeted audience effectively. The blockchain business model also holds an equal share in appealing to users for utilizing your application, as it contains distinct consumer segments and helpful value propositions. Now, what are the benefits you can receive are mentioned in an upcoming section.

Key Takeaways of Blockchain Marketing

Many brands utilizing the approaches mentioned above for advertising their blockchain related items might have known the certain benefits of the same. Below are some perks stated that you can receive by performing the marketing using blockchain technology.

Track Keywords

Keywords are basically fetched from the search results of tons of users across the globe on Google. Marketers mostly suffer from tracking the indexing of keywords searched by users from different regions and devices.

While by using blockchain, you can receive the rankings of every page along with knowing the location and particular device category. It will assist the promoters in determining appropriate measures they require to take to remove specific loopholes existing in their practices, along with focusing on particular types of devices.

However, the data extracted can also be utilized to decide why specific locations are being addressed on Google apart from others.

Also Read: What is BAAS(Blockchain As A Service) And Its Future?

Quality Insights

Performing these actions of blockchain marketing can help you gain a rise in the number of insights by increasing visitors to your solution. The users who get convinced to provide their essential data justify that they are interested in your organization.

You can transform these leads into real conversions by supporting their likelihood and giving them whatever it takes to fulfill their needs efficiently. In addition, to improvise the overall quality of marketing, you can analyze the user information received and advertise accordingly.

Besides this, following a strategy of blocking other companies’ ads and displaying the ones about your product/service you offer to users will help your customers know your offerings and assist in gathering a massive audience.

Transparency For Consumers

Veracity is the most crucial factor to consider due to increasing vulnerabilities. Using blockchain technology, you can easily maintain authenticity by abiding the certain marketing techniques discussed earlier and can attract Gen Y and Z to use your solution as it wins their trust in keeping their data safe.

Moreover, you can also display to them an entire journey of your item/service offered to them, as they are interested in knowing the percentage of originality to get an idea of whether it meets their set standards or not. It is easily possible through blockchain; customers gain information about your offerings by checking it.

Thus, keeping the utmost transparency with consumers will help your venture grow substantially and also allow entrepreneurs to execute several business operations efficiently with minimal costs.

You might have gained an idea of the certain benefits stated above that you may receive by adhering to the specific blockchain marketing process, as mentioned earlier. Besides this, there are many other positives and distinguishing points that sets blockchain apart from other tech stacks existent.

Bottom Line:

Today, the interests of users are gradually diverting towards solutions geared with the blockchain tech stack. The number of blockchain users is burgeoning with every passing year. So, it is a golden opportunity for startup owners to create solutions using particular tech stuff, which would give a commendable rise to their ventures.

Besides this, if you are keen to promote an enterprise by enabling the use of blockchain, then here is a brief understanding of blockchain marketing, specific procedures to follow, and the advantages you receive by complying them mentioned. It would help you appeal to a significant targeted audience.

![ICO Statistics [year]](https://www.coinideology.com/wp-content/uploads/2019/04/ICO-Trends-2019.jpg)

![Is ico profitable this [year]](https://www.coinideology.com/wp-content/uploads/2019/03/is-ico-profitable-in-2019.jpg)